Just enter your local airport, select a few top vacation spots, and that’s it. Sign up for Scott’s Cheap Flights to save big money on airfare. How can you find the cheapest possible flight without all that hassle and frustration? Save on Your Next Flight To Cushion Your Budget

#DAVE RAMSEY BUDGET PROFESSIONAL#

You need need a professional negotiator on your side.

#DAVE RAMSEY BUDGET FREE#

Get the free Trim App here because your bills should be lower. But you keep 100% of the savings after that. For example, if Trim saves you $10/month, they will request their 33% fee ($40) right away. Please note that Trim takes their payment immediately.

But if Trim does lower your bills, you keep 66% of the savings the first year and 100% of your savings every year after that. If Trim is unable to lower your bills, you pay nothing. Trim saved their users $1M+ last month alone. A real person from Trim wants to negotiate lower monthly payments on your internet, phone, cable, and medical bills, and they’re very good at their job. Internet providers charge higher rates to customers who don’t fight for a lower price. Trim – Lower Your Unwanted Billsĭo you feel like your getting ripped off on your internet? You probably are. But do you really need to pay for Hulu, Netflix, HBO, and Disney+ at the same time? Is that making your life better? Cut spending on the expenses that don’t make your life better. You have a mortgage your home makes your life better. Think of every dollar you spend as an opportunity to make your life better.

#DAVE RAMSEY BUDGET HOW TO#

Here’s a tip on how to make it easier to stick to your budget: create a budget you want to stick to. Everyone in your family needs to be on the same page. You worked hard to create a budget, don’t ruin it by not following it.

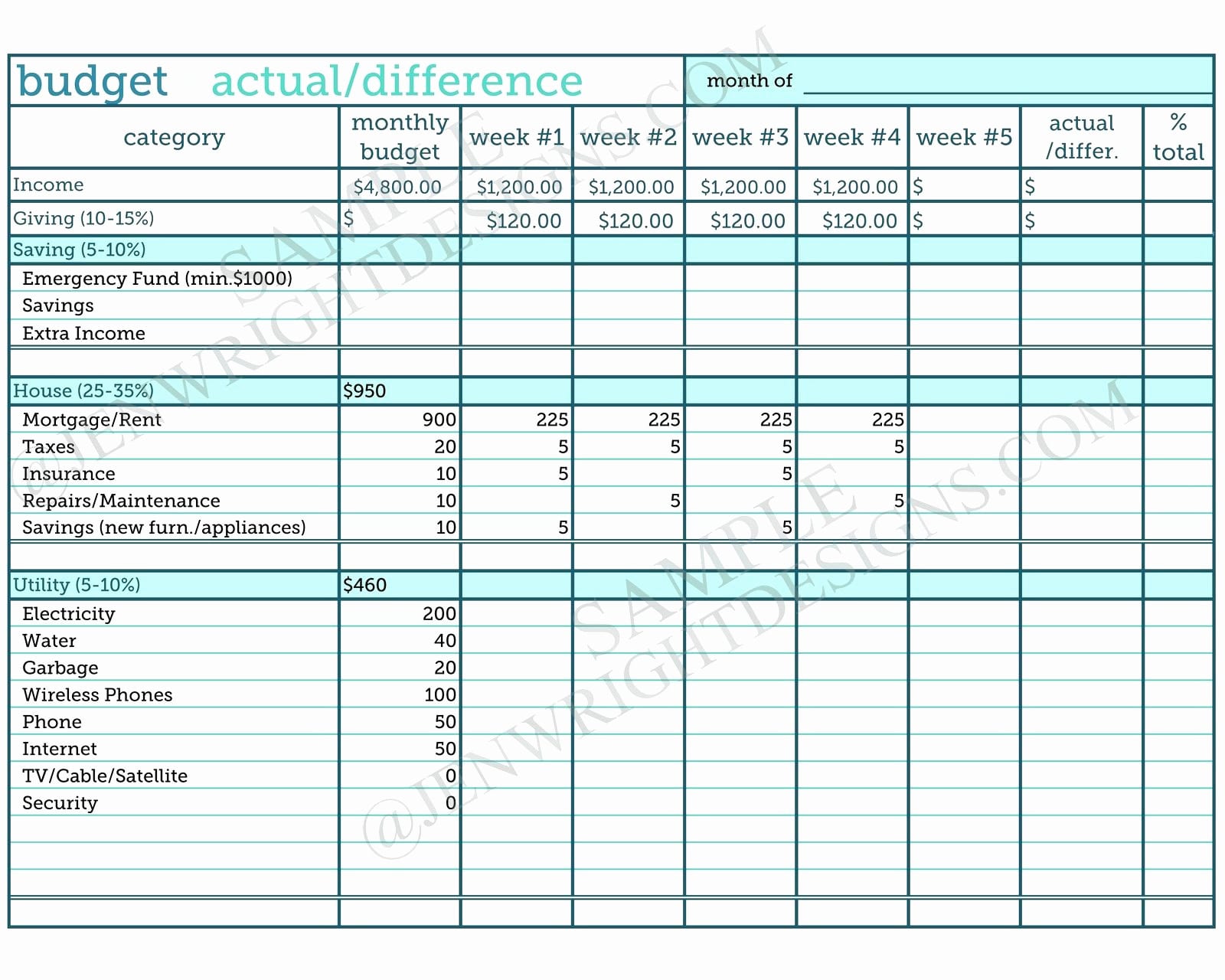

What’s more? We’ve got a bunch of free money-hacks to share with you: You will build your savings and pay down debt. Because when you can spend less than you earn, your money has no choice but to grow. Join our FREE Simplify Money Workshop to learn the fundamentals of growing wealth. That means you need to decrease your expenses or increase your income. The *only* way to save money is to spend less than you earn. Free Workshop – Join our free Simplify Money Workshop If you have a negative number, then you’re going to have to make some cuts. If you have money left over on paper, then figure out where you want to put it (like toward debt or savings or Christmas). When you subtract your expenses from your income, you should be at zero. This includes bills, savings, discretionary items like restaurants, entertainment, Starbucks and clothing, and whatever else you spend money for. With a zero-based budget you write down the amount of money you will receive in for the month and figure out where it will be spent. Dave Ramsey suggests a zero-based budget in which you give every dollar a “name.” This means that every dollar that comes into your home is assigned a purpose. There’s no getting around it, if you want to have control over your finances you need to have a budget. While some of his teachings can be a little controversial, nearly 2 millions families have found financial peace. These Dave Ramsey Tips Will Lead You to Financial Freedomĭave Ramsey has taught people how to get control of their finances for decades. Make simple changes to gain control of your finances and give you a peace you didn’t think possible. And we’ve got tips right here to help you make it happen.ĭon’t let financial insecurity be your destiny. So how are we going to make his plan easier for you? We want to help you lower your bills and increase your income. You know his strategy: spend less on yourself, and put that money towards building your emergency fund and becoming debt free. Ramsey is the man with the financial plan.

0 kommentar(er)

0 kommentar(er)